As our team worked away on the latest overnight developments worldwide, we continue to monitor reports about shootings outside the British Parliament in London--and that the building is in Lockdown. This is as a number of key developments loom on the health care law and as the market took a major nose dive yesterday. Sean Spicer, the White House Press Secretary, was rather dismissive as he said it was a one-day nonevent. Tory Newmyer captured the essence of it in his latest snapshot:

Keith Olbermann's take is even more devastating:

As The "Resistance" 60 Day sinto his presidency--Donald Trump is a Loser-----

|

As The "Resistance" 60 Day sinto his presidency--Donald Trump is a Loser-----

NEW: His Russian Scandal is only the largest tire fire. 60 days in, everything Trump has touched has failed. pic.twitter.com/HSGzo1aiyj— Keith Olbermann (@KeithOlbermann) March 22, 2017

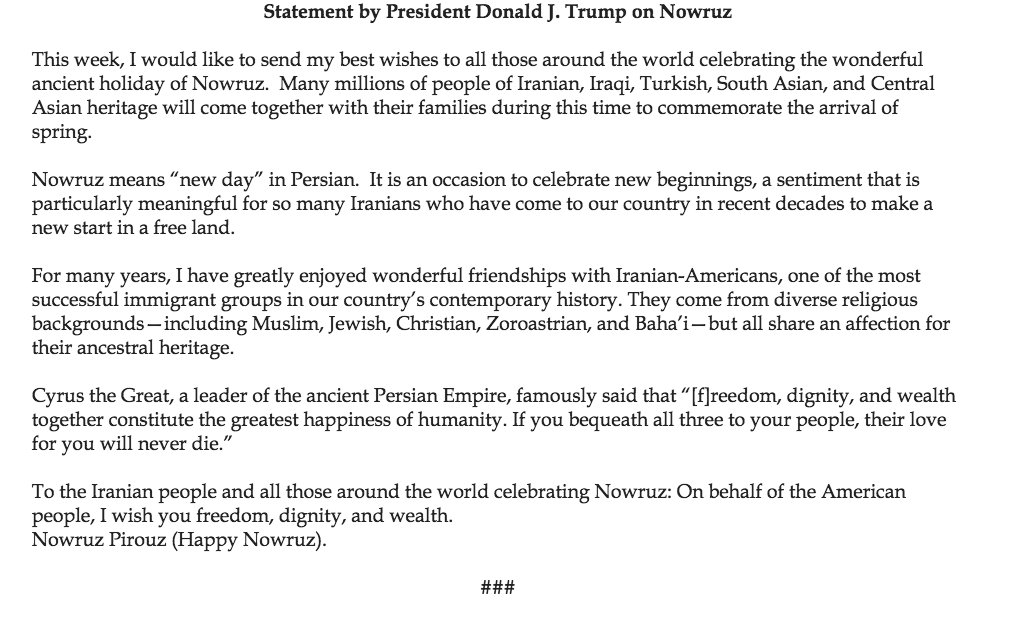

We conclude by noting this Nowruz greeting from President Trump