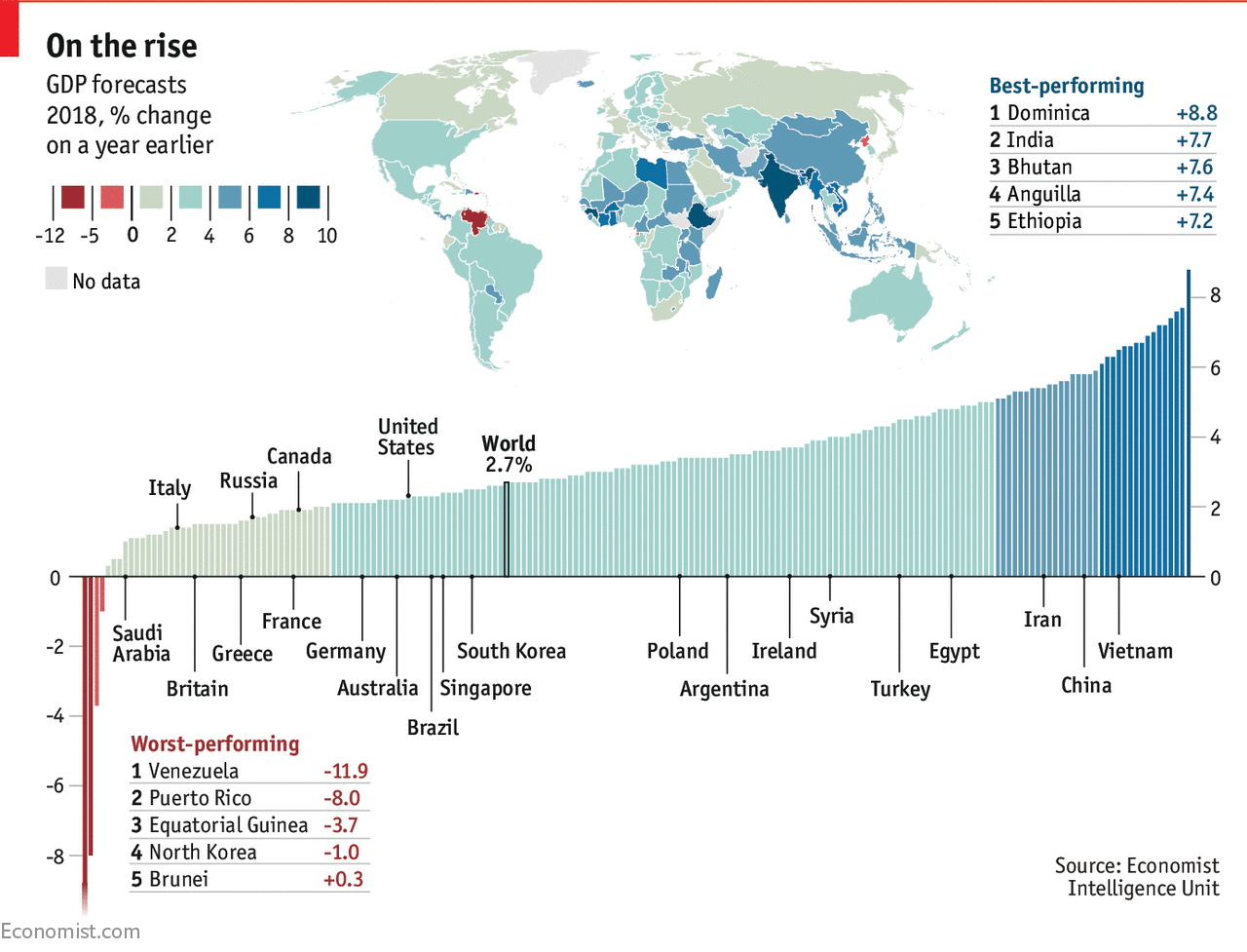

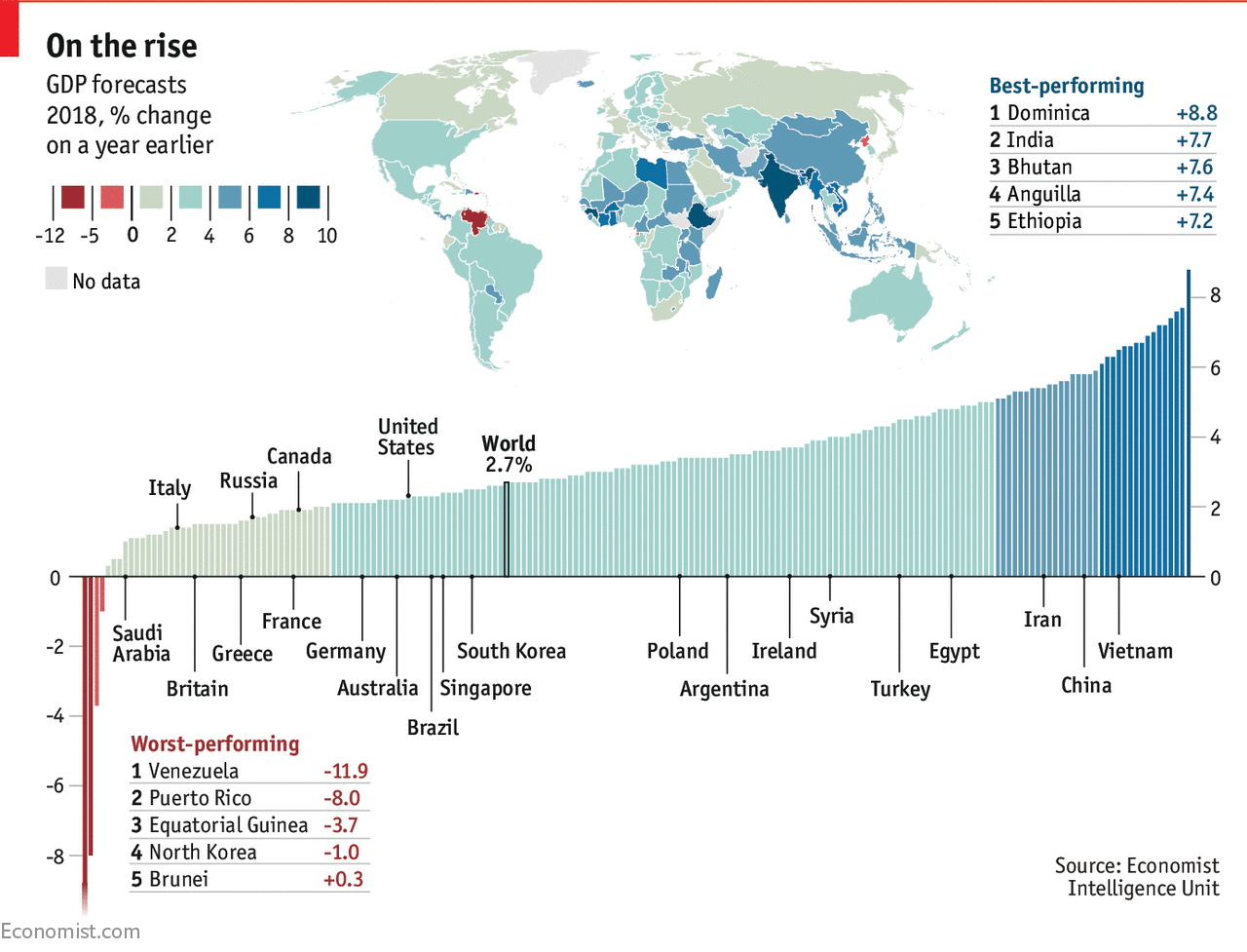

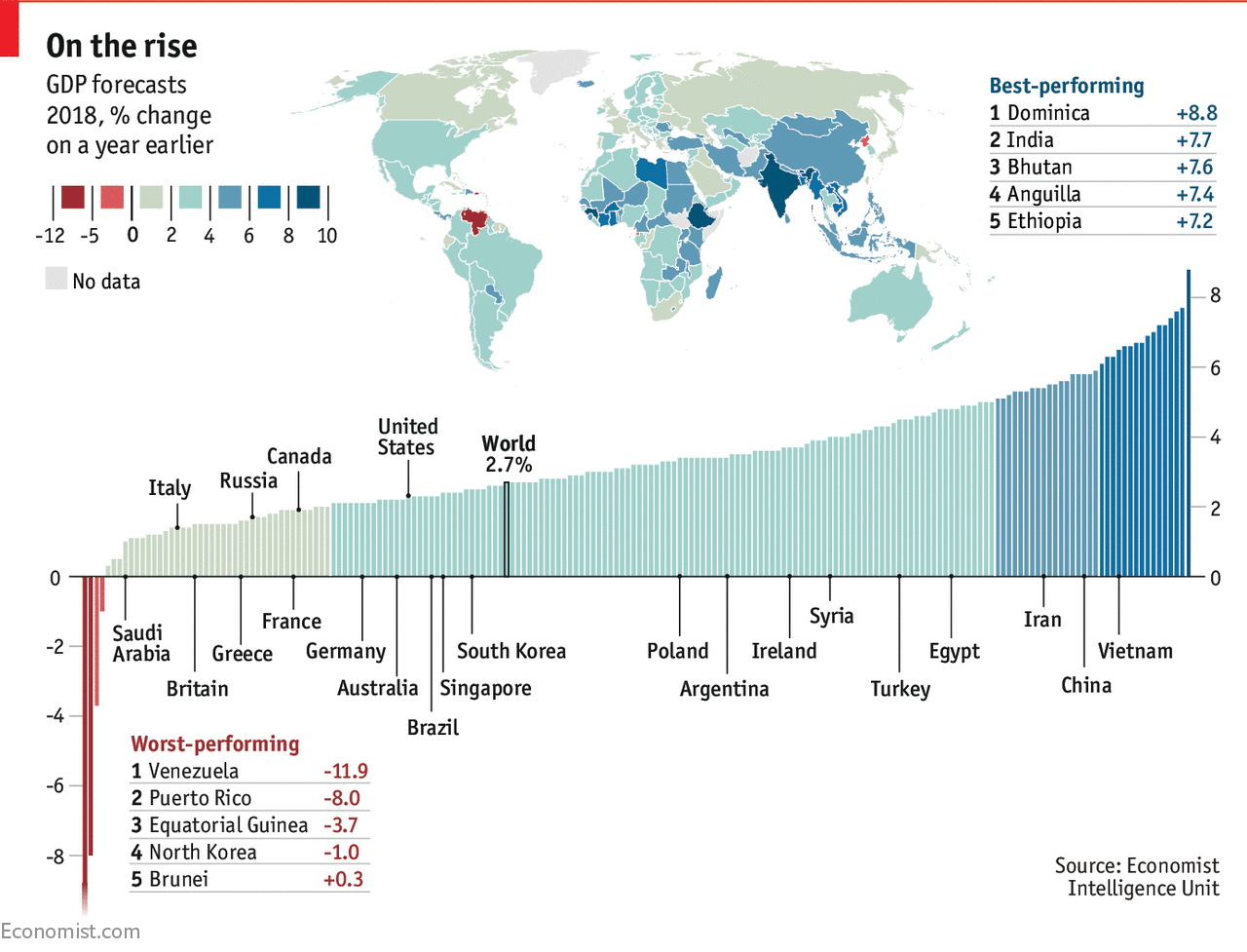

The Economist released this earlier this week on the status of the World Economy in 2018:

This is as this was released from Goldman Sachs:

|

Strong growth and divergence in inflation and monetary policy are among the key themes likely to define the year ahead for the US, Euro area, and Asia Pacific region, according to 2018 macroeconomic outlooks from Goldman Sachs Research. As discussed in a new video series, GS Research's regional economists forecast:

- Above-trend growth in the US, Euro area, and Japan, and continued strength across Asia (albeit a modest slowdown in China). India in particular is likely to see a rebound, with Chief Asia-Pacific Economist Andrew Tilton predicting 8% growth as aftershocks from 2017's demonetization and new taxes wane.

- Firming inflation in the US and Asia, but continued "lowflation" for Europe. While the Euro area, like the US and Asia, has seen economic slack decline over the last year, Chief Europe Economist Huw Pill says subdued wage growth and price pressures in Germany should keep area-wide inflation well below the ECB's ~2% target. As such, you can expect...

- Monetary tightening from the Federal Reserve and Asian central banks, but continued dovishness from the ECB. The Fed in particular is likely to lean against "too much of a good thing" by meeting above-trend growth, low unemployment, and firming inflation with four interest rate hikes in 2018 -- a forecast that puts Chief Economist Jan Hatzius above market and FOMC expectations.

|

|

|

|

|

|